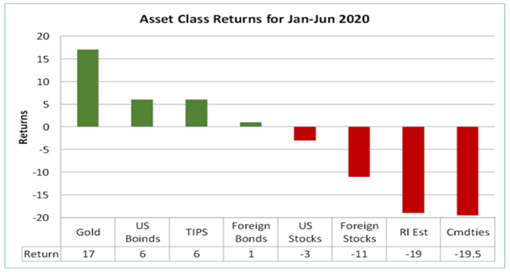

The first half of 2020 was quite a rollercoaster ride for the financial markets. The S&P 500 reflected the unparalleled drop in economic activity during the first quarter with a sharp decline (-19.5%). It was the fastest peak to bear market drop in history. Fortunately, the country began moving out of lockdown in the 2nd quarter resulting in the sharpest quarterly rally in 20 years. Overall, the S&P 500 ended June nearly breaking even with a -3.3% return. The following are trends that stood out in the first half of the year:

- The 5 largest stocks by market cap delivered the bulk of the return for the period.

- Growth stocks are now ahead of value by over 25% representing the largest margin between the two in 21 years.

- Gold, a frequent safe haven during volatile times, surged throughout this year with a solid first half performance (17%), topping $1,800 per ounce. It was the best performing asset-class for the period.

- Only three sectors (technology, consumer discretionary and communication services) recorded gains by the end of June, reflecting the overall lack of market breadth in the rally.

- The economic roller coaster experienced in the US was also felt overseas. In terms of international stock performance, the emerging markets have held up the best outperforming the developed country index modestly. Among the larger economies of the world, China, Japan and Germany performed the best.

- The Federal Reserve’s lowering of interest rates caused a bond market rally. Longer duration and higher credit quality bonds outperformed in what was generally a broad-based rally.